2024

QuickBooks: Automating Identity Verification for ProAdvisor Directory Profiles

I partnered with the QuickBooks ProAdvisor team to redesign and automate the identity-verification and onboarding experience for financial professionals entering the program. This zero-to-one initiative enabled me to own discovery, system mapping, component design, cross-functional alignment, and final launch.

The result: Experts onboarded faster, customer support cases fell by 20%, and the organization saw greater operational efficiency and improved conversion through better product matching.

Only 5% of Eligible Experts Were Completing Onboarding

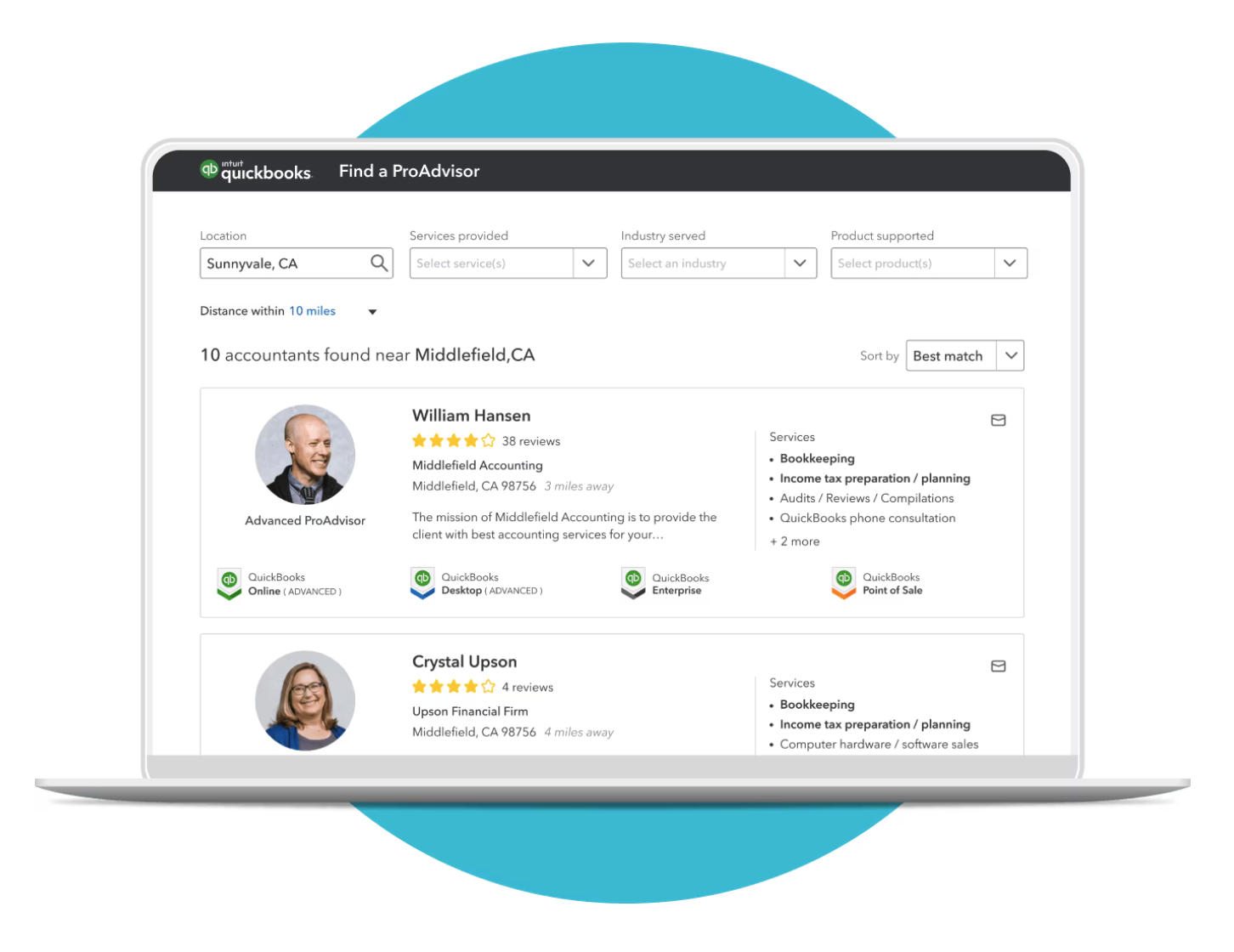

The QuickBooks ProAdvisor Directory™

It enables thousands of financial professionals to market their services to over 2.6 million small businesses nationwide. However, the identity verification and onboarding process was highly manual: multiple phone calls, duplicate data-entry across systems, long wait times and heavy operational overhead.

At scale, this was unsustainable — delays in publishing experts meant slower growth of the network and frustrated users who just were abandoning the onboarding process out of frustration.

Research and Discovery

Auditing And Asking Questions

I reviewed archived user study sessions and watched customers try to onboard on the QuickBooks ProAdvisor Program and publish their profile. It was painful to watch and the following insights emerged:

Experts have to complete required certifications, in order to be considered ready to be part of the ProAdvisor program.

The onboarding process introduced significant friction before an expert could publish their profile. Experts had to speak with an agent and complete a manual identity check before they could participate in the program..

Long verification wait times caused many experts to disengage or abandon the onboarding process entirely.

🤦🏾

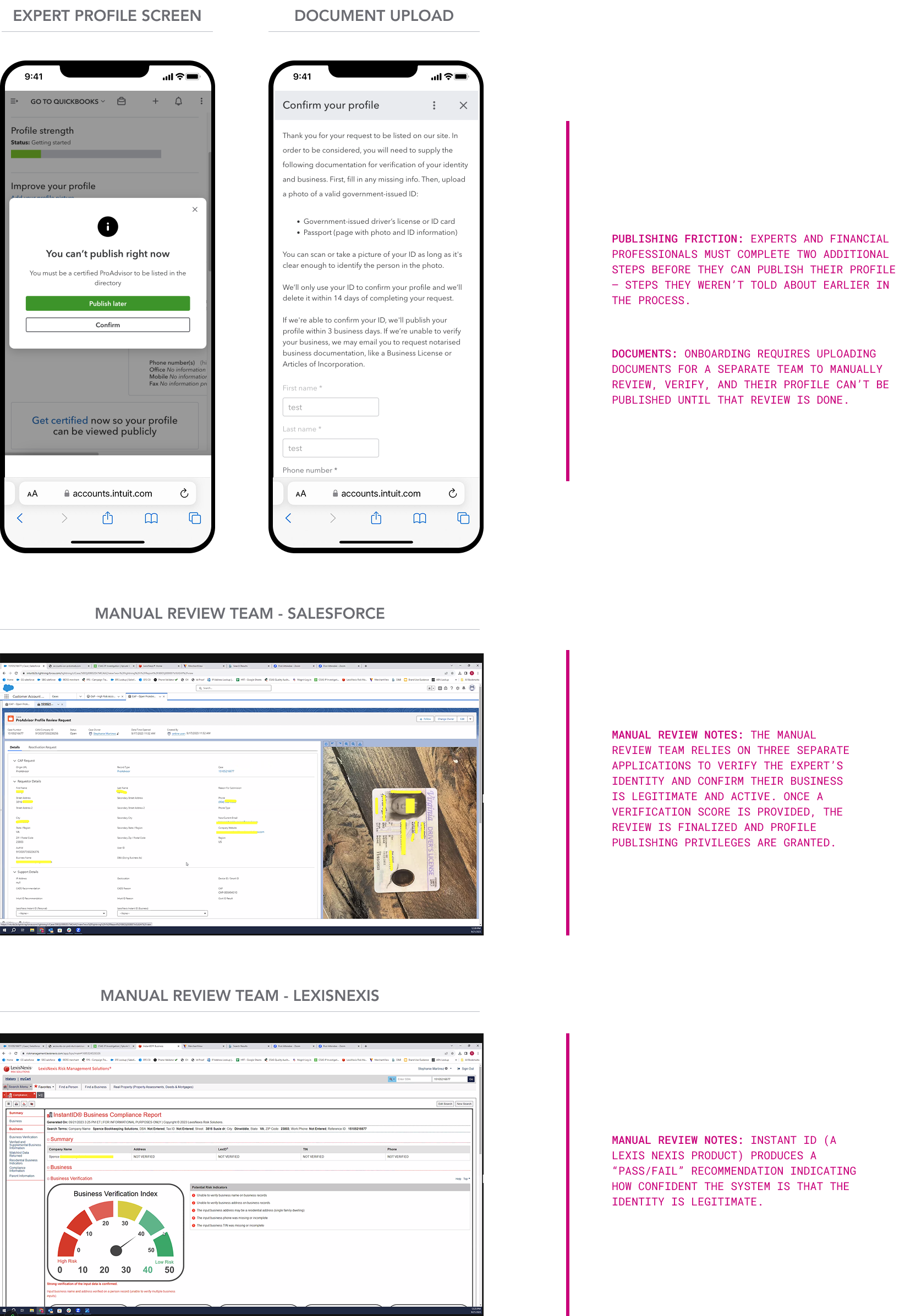

More Profile Publishing Friction

I uncovered that even after completing trainings, experts hit a second barrier: a manual document-review and identity-verification process spread across multiple disconnected systems. This multi-system workflow created delays.

Solution & Design Impact

How Might We Enable Identity Verification In Seconds, Not Days

To address the fragmented, manual onboarding system, worked with my product manager and QuickBooks leaders to find a solution to embed a third-party identity verification service directly into the onboarding experience. I led the end-to-end design effort — defining the experience from early concepts through high-fidelity UI, aligning with engineering on validation logic, driving E2E QA, and mapping happy/unhappy paths. This work enabled:

“Submit once, never re-enter” data flow — Verified identity and business information was securely passed into QuickBooks Online Accountant and used to automatically populate the expert’s profile, eliminating redundant data entry and reducing onboarding friction.

Dynamic, entity-aware verification — The experience intelligently adapted to business structure (sole proprietor, LLC, corporation), collecting both KYC and KYB information within a single, cohesive flow.

A reusable design system foundation — I built a dedicated component library for verification patterns, enabling future teams to scale and repurpose the identity verification flow across multiple Intuit experiences and products.

My Role & Contributions

Things I Lead and Owned

Served as Platform/Identity SME for the ProAdvisor team — bridging business, UX and tech to deliver a cohesive experience.

Drove full-lifecycle design: ideology → sketches/wireframes → high-fidelity UI → prototype → developer collaboration → launch.

Built and maintained the component library to ensure scalable, consistent experiences across identity and onboarding flows.

Defined and managed verification triggers and flows (onboarding vs re-verification) and aligned these with backend logic and policy requirements.

Participated in post-launch E2E testing, working cross-functionally to ensure smooth rollout and operational readiness.

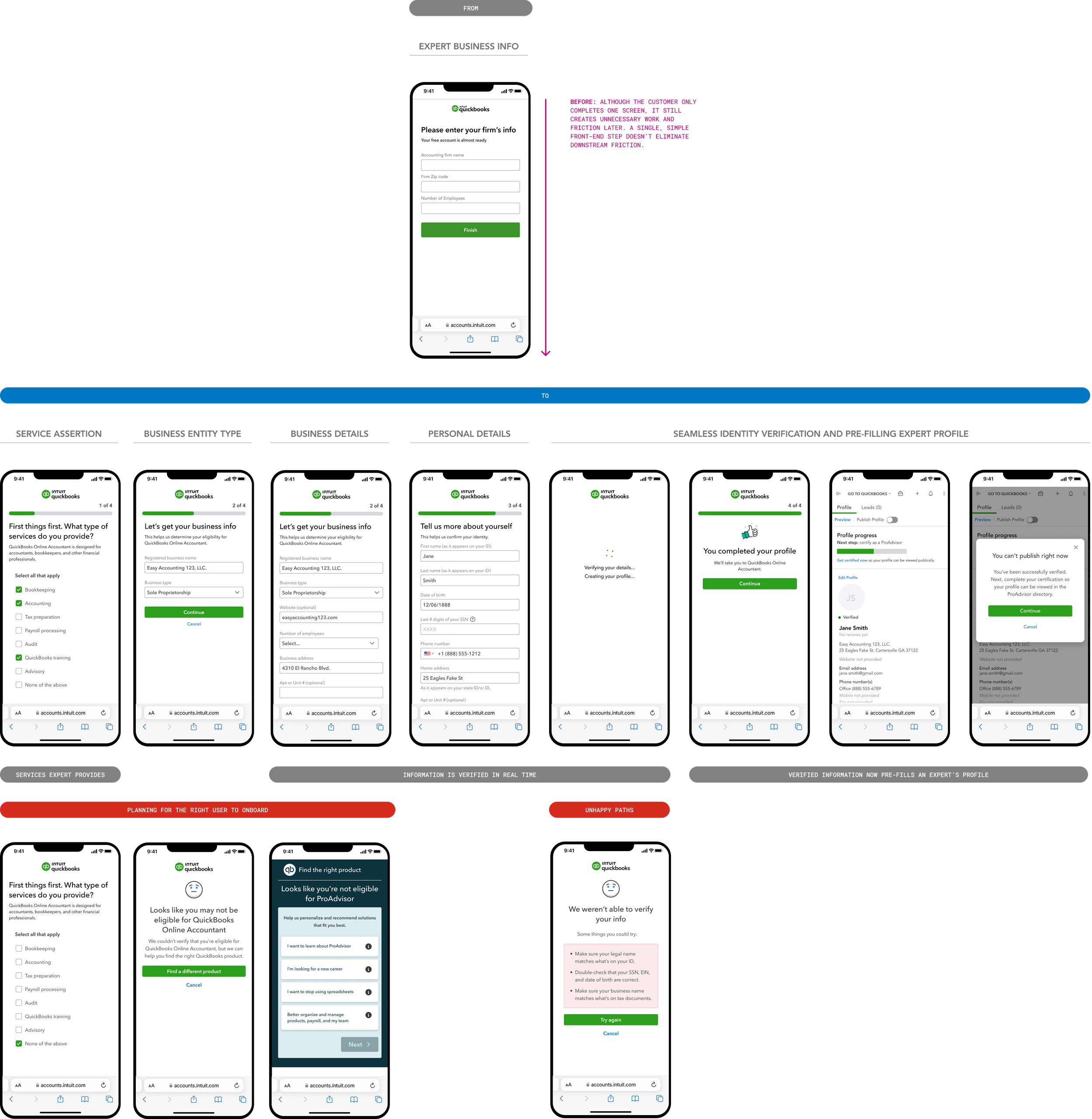

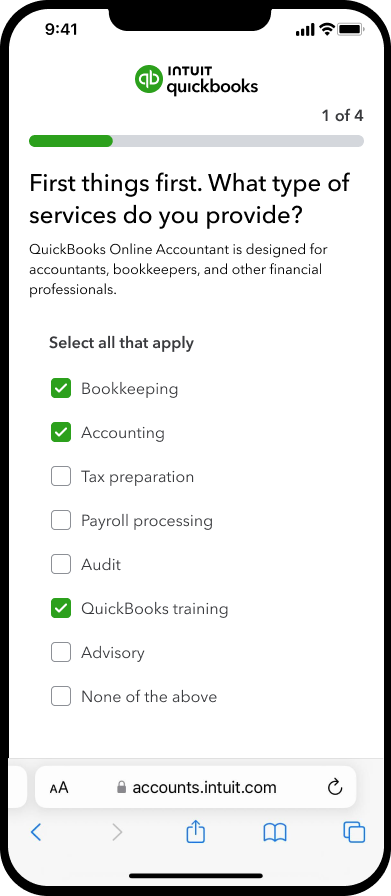

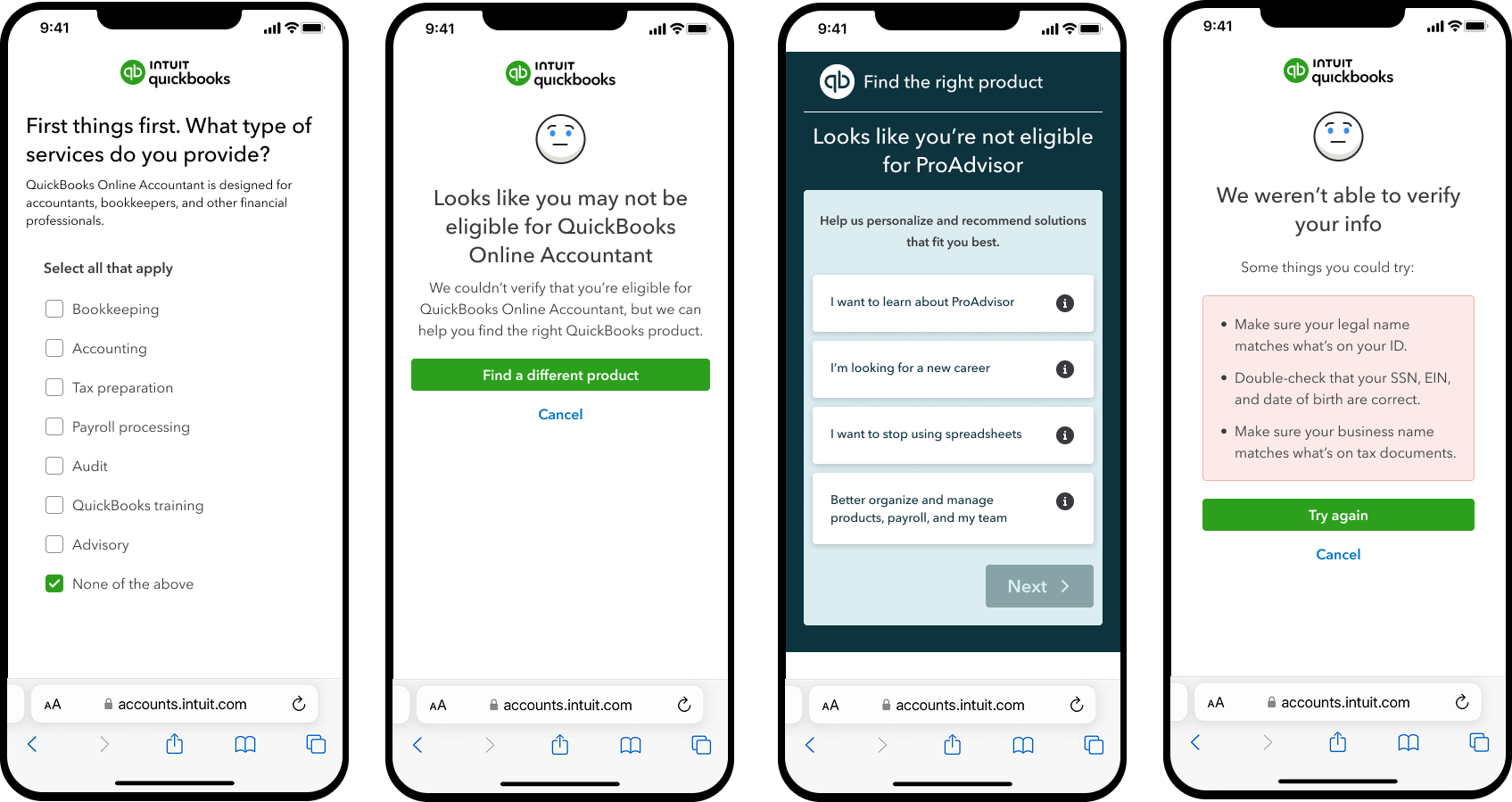

Service Assertion Screen

In the new ProAdvisor onboarding flow, service expertise is captured upfront that reflect professional focus, enabling those inputs to automatically pre-fill key areas of their QuickBooks profile and significantly reduce manual setup time.

By introducing this structured service-selection model, we not only improved onboarding efficiency but also enhanced the quality of ecosystem product recommendations.

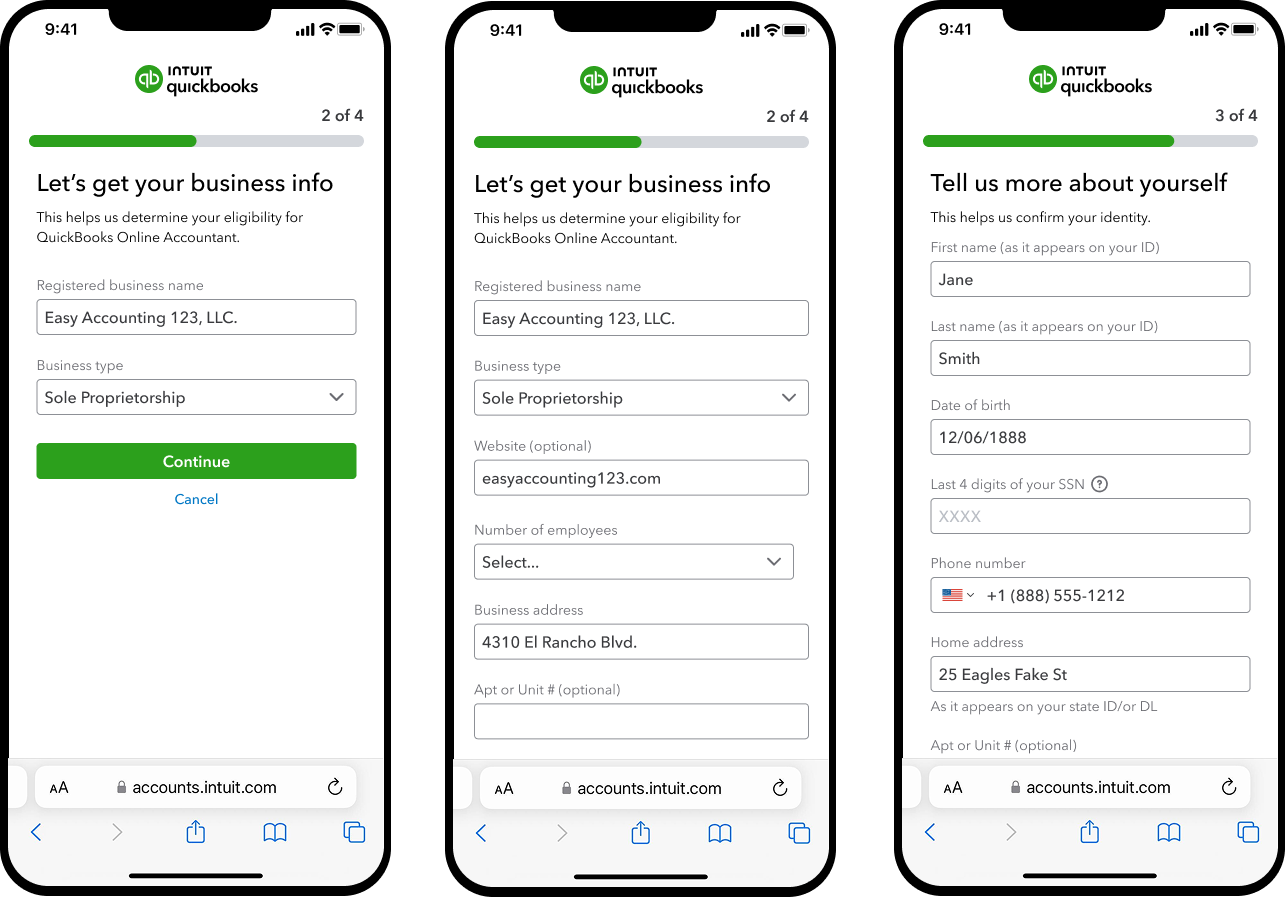

KYC and KYB Verification Screens

The onboarding experience includes contextual UI logic that dynamically surfaces the required fields based on the customer’s selected business entity type. Because identity verification applies at both the business (KYB) and individual (KYC) levels—regardless of whether the user is a sole proprietor, LLC, or corporation—the flow needed to support both personal and business-level data collection.

In our research, the majority of users were sole proprietors, which made personal identity verification especially critical. To accommodate a technical constraint, I designed an additional screen dedicated to capturing the registered owner’s personal information to ensure both levels of verification could be completed smoothly.

How The Automated Verification Works Better for Users

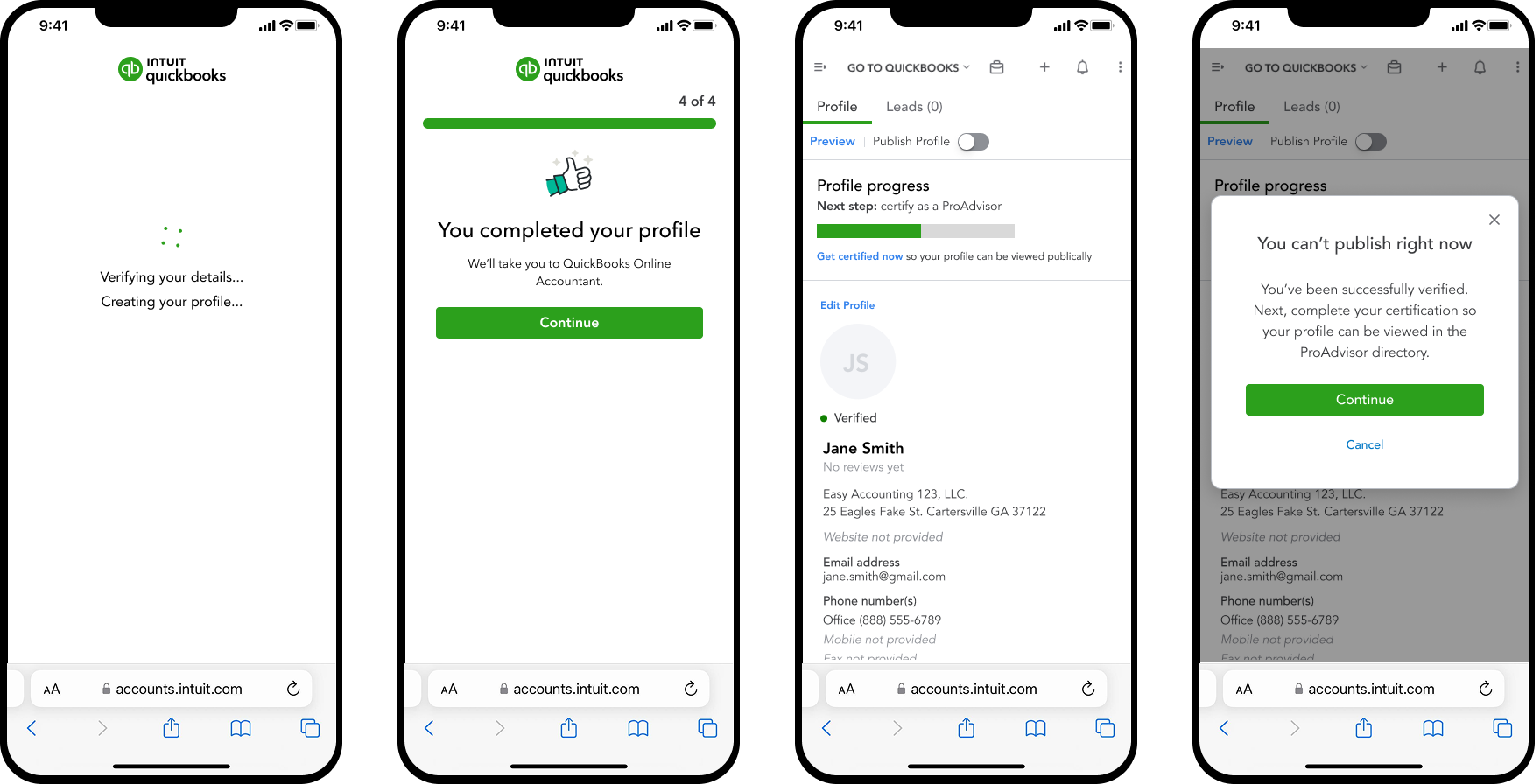

When the user submits their information, the frontend talks to Intuit’s Identity Platform. That backend service packages the user’s personal and business details and sends them to a trusted third-party verification provider (think: Equifax, LexisNexis, or a similar KYC/KYB vendors). While this is being processed, the UI enters the loading state shown in the first screen, clearly signaling to users that their identity is being verified.

Once verification is successful, the UI advances to the confirmation screen (“You completed your profile”). Behind the scenes, Intuit’s Platform services orchestrate the data flow across the ecosystem: the verified identity and business information is automatically synced into the user’s QuickBooks Online Accountant (QBOA) profile.

This moment is important as it signals that the user’s identity has been validated, their information has populated across systems, and they are ready for the final step: completing their ProAdvisor certification before their profile can be published in the directory.

Designing For the Unhappy Paths

A critical part of redesigning the ProAdvisor onboarding experience was defining clear, supportive unhappy paths that guide users when they cannot proceed. The previous flow stopped users abruptly with little explanation, leading to frustration, support calls, and unnecessary drop-off. I designed a set of structured alternative paths that maintain clarity, reduce confusion, and direct users toward the right next step.

The Results

This was the first Intuit Platform use case proving how shared customer data could streamline onboarding and accelerate first-time use across the ecosystem. The impact extended beyond QuickBooks — the TurboTax team also recognized that onboarding didn’t need to live within each product, but could be powered at the Intuit Account level.

Post-Launch Insights

Uncovered an operational insight: many failed verifications correlated with bad-actor sign-ups, pointing to additional opportunities for platform security and risk management.

Some users, being ineligible for the ProAdvisor network, converted into paying QuickBooks Online customers after being routed through the upgraded onboarding path — creating an unexpected revenue channel

Credits.

-

Matthew Lett - Sr. Product Designer

-

Carrie Deakin (Sr. Content Designer)

-

Hami Nejadriahi

Rudy Serna

Michael Offenbecher

Ranjith Kumar Narayanaswamy -

Jason Gu

-

Keya Tollossa